WHY DUBAI

Explore Dubai

When selecting destinations for relocation or investment, it's important to have a clear set of priorities and fundamental criteria for identifying lucrative locations. In this article, we've highlighted several examples and recommended examining the habits of the world's wealthiest individuals. After all, if they've built vast fortunes, they must know something—so why not benefit from their insights?

Content:

- The expansion of tourism and the arrival of affluent residents

- Numerous factors draw millionaires to the UAE.

- For potential investors

- Why Consider Investing in Real Estate?

- Why is a reliable agent essential?

- Why make a purchase now?

The expansion of tourism and the arrival of affluent residents

Dubai consistently ranks as one of the most appealing cities globally. According to Euromonitor International, a global research firm, the city leads in tourist and excursion arrivals, attracting 16.8 million visitors.

In December 2023, Dubai's hotels saw record occupancy rates, significantly boosting their revenues. CoStar Group reports that the average daily room rate (ADR) for the month reached its highest level ever.

In 2023, 4,500 millionaires relocated to the United Arab Emirates, according to Henley & Partners, cementing the country's reputation as a hub for wealthy individuals worldwide. In the capital migration ranking, the UAE ranked second, following Australia, which saw 5,200 millionaires move there.

"Statistics on high-net-worth individual migration speak volumes. Affluent families are highly mobile, and their movements across borders can provide early signals of a country's economic health and future trends. Like the canary in the coal mine, they alert us to potential dangers, as they are more sensitive to threats to their wealth and usually have the means to take corrective actions to safeguard their legacies."

— Dr. Juerg Steffen, CEO of Henley & Partners, the global leader in capital migration studies.

Numerous factors draw millionaires to the UAE.

Security: A critical consideration, especially in uncertain times, which is why a significant amount of private capital is invested in the UAE. Dubai provides a stable regulatory framework: the country upholds the rule of law and ensures economic freedom.

Taxes: Dubai is one of the most popular foreign markets right now for a variety of reasons. There is no real estate tax, capital gains tax, or income tax—appealing to many buyers, especially those from the United States.

Healthcare: The UAE is renowned for its world-class medical facilities, drawing many international patients seeking top-quality care.

Luxury and Entertainment: The UAE offers a diverse range of entertainment options, from high-end shopping malls and restaurants to premium real estate and exclusive communities.

Education: The UAE is home to over 200 international schools, offering excellent educational opportunities for the children of wealthy families.

Resort Lifestyle: With its beautiful beaches, waterparks, and marinas, the UAE is a year-round destination for relaxation and recreation.

For potential investors

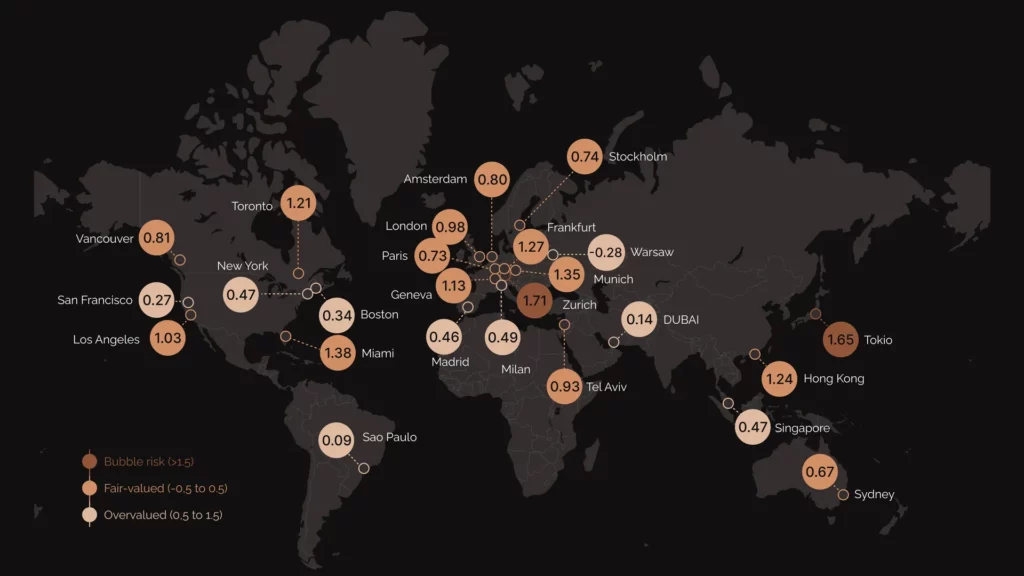

While Dubai is often associated with oil revenues, its primary sources of income are actually tourism and real estate. According to UBS analysts in the UBS Global Real Estate Bubble report, the city's real estate market is considered "not overvalued," with its true value significantly surpassing the current market prices, suggesting that Dubai is shielded from a real estate bubble.

An index value above one signals the potential for a market bubble. If the index approaches 1.5, it indicates an imminent risk of a collapse, which would result in a decline in real estate prices and demand, potentially leading to investor losses.